Unconventional Assets and Data Management

New risks create a need for improved data management in the oil and gas world. One of the greatest risks in unconventional shale development is the risk of not being able to manage an increasingly complex group of assets in an environment that is constantly changing.

That’s why data and its intelligent management are among the most essential assets any E&P enterprise can possess. We will take a look at some of the most ground-breaking data acquisition projects currently underway and also look at the complexities involved.

Unconventional E&P plays and data integration

Turning data into knowledge is a process that converts unconventional shale geophysical information into an asset that can be used upstream. There are specialized software tools for each step. Individual shales are different and it’s necessary to integrate a vast array of data to form a clear picture of discrete products.

Integrated software solutions incorporate a complete selection of asset-based applications such as reserves assessment, reservoir management, and exploration and production workflows.

Decision analysis uncertainty modelling offers applications that clarify financial decisions, reserves assessment, and portfolio management. A petroleum reserves management system provides an effective way to evaluate and manage reserve values and revisions.

A complete toolkit of geological and geophysical technologies enables geologists and geophysicists to widen their areas of exploration and evaluate more data with greater accuracy and insight. Powerful algorithms applied to larger data-sets ultimately results in innovative analysis, visualization, and automation.

Data management is essential for maximizing the value of your data assets. Now it is easier than ever to identify very subtle traps in non-conventional plays.

Unconventional shales bring to light geophysical data that will shape exploration

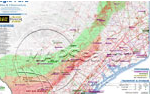

ION Geophysical Corp purchased 235 square miles of new 3D multi-client seismic data in the Marcellus Shale play. Data was acquired with INOVA FireFly acquisition system and VectorSeis® digital sensors.

Seismic attribute analysis and other interpretation deliverables are included. The Marcellus Shale produced over 1.4 trillion cubic feet of gas during the first half of 2013, according to new data released by the state Department of Environmental Protection.

The Marcellus shale has been determined to contain 84 trillion cubic feet of new, recoverable natural gas and over 3 billion barrels of recoverable natural gas liquids, according to a USGS assessment. Economic viability in shale plays has traditionally been achieved through horizontal drilling and hydraulic fracture stimulation.

The Marcellus shale has been determined to contain 84 trillion cubic feet of new, recoverable natural gas and over 3 billion barrels of recoverable natural gas liquids, according to a USGS assessment. Economic viability in shale plays has traditionally been achieved through horizontal drilling and hydraulic fracture stimulation.

NEOS director Lance Moreland said: “We’ll be acquiring new airborne geophysical datasets – magnetic, electromagnetic, radiometric, and gravity –and integrating these with existing seismic and well information, both of which are in short supply given the emerging nature of this play.”

This survey will provide high-value data which will supply underwriters with the necessary information to evaluate the exploration potential of prospective development locations.

Previously conducted viability tests of electromagnetic (EM) measurements in this area have yielded encouraging results. Seismic surveys were less than successful due to difficulty in imaging subsurface areas.

Airborne, passive-source EM data has led to valuable EM related insights. Data will be available for licensing to others in 2014.

Complex data means sophisticated data management

CFO’s of oil and gas E&Ps must be able to manage a highly complex set of requirements. Appropriate technologies for rapidly changing environments must be in place. Monitoring and maintaining costs is essential and must include all areas of an enterprise, from risk analysis to error correction rates.

The need to increase the availability and reliability of exploration assets while complying with health and safety requirements is also part of the equation. Managing asset lifecycles with a service oriented approach that focuses on cost issues, profitability, and risk minimization means good business intelligence.

When you are evaluating solutions, the best choices in oil and gas software are those that can control 80% or more of operating and maintenance expenses. Being able to dramatically increase the visibility and control of your enterprise wide assets is a necessity in the vast and changing operating environment of unconventional shales.

For more on using data to get ahead, check out this post on strategies Upstream companies are using right now…