Data Management During M&A

During a merger, data management and systems integration are often overlooked factors in the success of the deal. The Houston Business Journal reported this past month that divestures were down from $30.4 billion in Q2 of last year to $17.2 billion in Q2 this year.

According to one commentator from PwC, one of the major reasons for this was the focus on “on integrating the assets they had acquired in 2012.”

We shared in a blog about mergers and acquisitions for oil and gas earlier this year, “50% – 70% of merger and acquisition transactions fail to ultimately create incremental shareholder value, oftentimes due to failed post-merger integration.”

So for many oil and gas companies, it may be that systems integration posed a larger challenge than decision makers originally anticipated. In his e-book, “Data Quality Assessment,” Arkady Maydanchik shares that although data consolidations are very common:

“Database consolidations after corporate mergers are especially troublesome because they are usually unplanned, must be completed in an unreasonably tight timeframe, take place in the midst of the cultural clash of IT departments, and are accompanied by inevitable loss of expertise when key people leave midway through the project.”

Data and Your Investment

Maydanchik goes on to describe a problem that is exceedingly common for oil and gas. When the two systems from the purchasing and acquiring companies (production numbers, leases, etc.) have overlapping data that do not line up, “the efforts to squeeze square pegs into round holes are painful, even to an outside observant.”

Considering that more than 50% of the investment during a merger is realized as a result of successful integration, this issue is clearly an important one. For the average oil and gas company, “there are duplicates, there are overlaps in subject populations and data histories, and there are numerous data conflicts.”

Maydanchik goes on to explain that the traditional approach of setting up a “winner-loser matrix” to merge data together can be very tricky. Assumptions have to be made, for example that lease data in system A should override data in system B, when no one is actually sure that the data in either system is right.

Maydanchik goes on to explain that the traditional approach of setting up a “winner-loser matrix” to merge data together can be very tricky. Assumptions have to be made, for example that lease data in system A should override data in system B, when no one is actually sure that the data in either system is right.

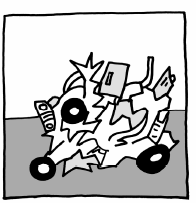

His image to the left demonstrates what can happen to data without a careful approach to merging databases.

Master Data Management

As a result of all of these factors, an investment in master data management isn’t a nice to have, it’s a must! Either internally, or with the help of a software consultant, your company should start by scrubbing all the available data so that it is correct and in the same format.

After that, the team must work strategically to determine what the system of record is, and then develop rules around how other associated databases should relate to that. For example, if the accounting department makes a monthly update, should those numbers override data in the production database?

Our director of consulting, Chad, walks through this process in greater depth in this podcast, “Master(ing) Data Management.”