Mergers and Acquisitions for 2014

The Rice Energy Finance Summit promotes forward-looking discussion on important energy issues, like mergers and acquisitions, and facilitates relationships in this business sector through the exchange of information and ideas.

Christopher Watson is a Managing Director in Investment Banking at Barclays who presented a keynote speech at the annual REFS conference on November 17, 2013. Watson’s speech addressed the decline in mergers and acquisitions during 2013 within the oil and gas sector, primarily attributing it to companies integrating the assets they acquired in 2012.

His topics included unconventional energy, capital markets and deal volume.

Unconventional Energy

Unconventional sources of oil and gas have the potential to change the marketplace, but they require large amounts of capital to develop. The capital outlay required to bring these resources to market primarily involves building out the required infrastructure, especially the midstream pipeline.

Transportation costs in the form of rail and trucking also play a significant role in developing unconventional energy sources. The Interstate Natural Gas Association of America Foundation estimates that the total cost of infrastructure in the United States for unconventional energy through 2035 will be $278 billion.

Wall Street Research estimates that exploration and production will comprise only 23 percent of the capital expenditures for natural resources through 2020.

Capital Markets

The capital markets for oil and gas are open and capital has been readily available in recent years. The total capital raises in 2011 was $165 billion, with $33 billion in equity raises and $132 billion in debt raises.

The total capital raises increased to $225 billion in 2012, with $43 billion in equity raises and $182 billion in debt raises. Total capital raises for 2013 were $181 billion as of October, with $38 billion in equity raises and $143 billion in debt raises.

Deal Volume

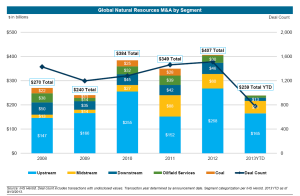

The number of mergers and acquisitions in energy decreased sharply in 2013. The total value of deals in 2013 through September 10 was only $239 billion, as opposed to $407 billion in 2012. One reason for this may be that companies are “focused on integrating the assets they had acquired in 2012.”

The number of mergers and acquisitions in energy decreased sharply in 2013. The total value of deals in 2013 through September 10 was only $239 billion, as opposed to $407 billion in 2012. One reason for this may be that companies are “focused on integrating the assets they had acquired in 2012.”

The “barbell effect” continues to characterize master limited partnerships in the energy sector, meaning that the number of mergers and acquisitions is relatively small compared to small cap and very large cap MLPs.

E&P valuations remain high, especially for independent operations that command premium prices. Environmental activists continue to be active in the energy sector, making mergers and acquisitions more difficult.

If your company is currently dealing with mergers and acquisitions and wondering if you are prepared for integration, find out more about M&A IT Assessment!