Merger and Acquisitions and Valuation

Amassing the right data is paramount to being able to arrive at an accurate valuation during mergers and acquisitions. Without data, it is easy to make decisions based on inaccurate intelligence.

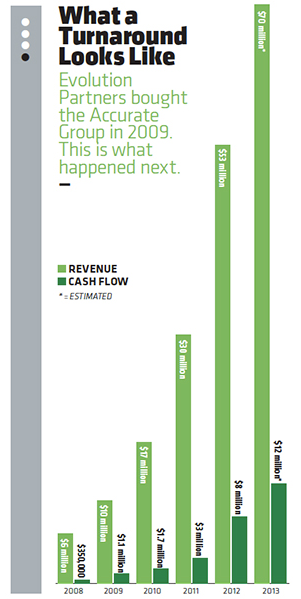

Take the example of Evolution Capital’s 2009 purchase of the Accurate Group, a small mortgage serving company based in Charlotte, North Carolina. Evolution Capital, a small Cleveland-based private equity firm saw potential in Accurate’s numbers, even though the physical appearance of the company left a lot to be desired.

First Impressions During an Acqusition

According to Inc. magazine, when Evolution co-owners Brendan Anderson and Jeff Kadlic first visited Accurate, the company’s servers (which powered their most promising asset, a software program that was capable of handling many thousands of real estate transactions at the same time) were being kept dry via a canopy of blue tarps hung under the company’s leaking roof and being cooled by discount store oscillating fans.

Based on this inauspicious beginning, it was difficult to judge whether their assets added up to a good investment.

Doing the Math

When the pair at Evolution Capital began crunching the numbers, they found that although the company’s EBITDA (earnings before interest, tax,  depreciation and amortization) was lower than Evolution’s target number, Accurate’s profit margin was a healthy 10 percent.

depreciation and amortization) was lower than Evolution’s target number, Accurate’s profit margin was a healthy 10 percent.

They bet that sales growth could help to beef up earnings. They also found an enthusiastic, knowledgeable CEO to run their new company, allowing the Accurate owner to step aside and do what he preferred, spending time on his yacht. They were right in their estimation.

Evolution purchased Accurate in 2009 for $6 million. By 2012, the company’s EBITDA had increased from $350,000 to $7 million and Evolution began to prepare the company for sale.

They found a buyer in late 2012 and sold Accurate for $55 million, earning the company’s investors a healthy 100 percent return on their investment, boosting Evolution’s total return to 31 percent and bumping up the company’s reputation as a financial player.

Making Investments Work

The lesson in the Evolution/Accurate acquisition and subsequent sale is to trust your instincts, but also be sure of the numbers. Only after Anderson and Kadlic were able to verify that the financials were good could they look beyond the pitiful computer room at Accurate to a product that was worth investing in.

For more on valuing assets before mergers and acquisitions, check out this case study!